TrueLayer launches its payment initiation solution

FACTS

- The British FinTech TrueLayer has made a name for itself on the European market with its account aggregation solutions, already implemented by players such as Plum, Sync and Revolut.

- With the AISP and PISP status, TrueLayer goes further in open-banking and launches PayDirect, its payment initiation API.

- The service relies on biometric authentication and automatic verification of payers' identity with their bank to ensure secure transactions as well as fast enrollment services for new customers.

- PayDirect is an instant transfer payment solution that allows, via a single API, to manage three stages of the customer's life:

- onboarding

- instant payment

- instant repayment

- The solution is aimed primarily at companies in sectors looking for solutions to streamline payments:

- the subscription sector

- e-commerce

- marketplaces

- online gaming

- Some references: Revolut, Freetrade, Nutmeg, Trading 212, LeoVegas.

CHALLENGES

- An alternative to payment cards: TrueLayer's credo is to convince its merchants that its open-banking transfer offers an answer to the problems encountered with card payments. Its argument is mainly based on two sources of friction:

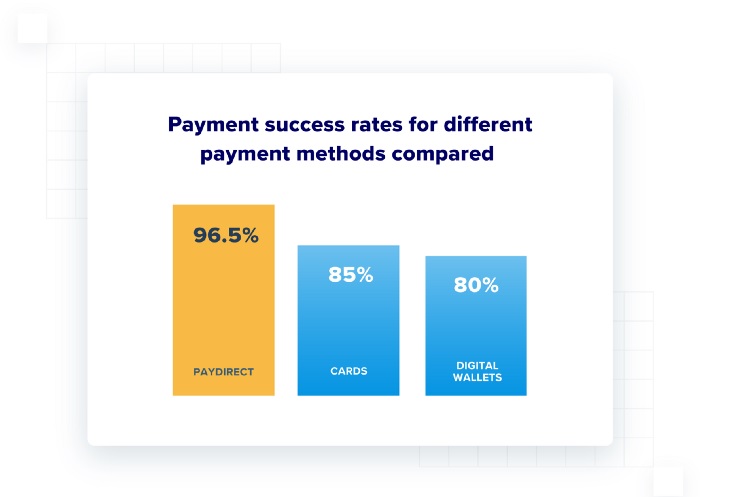

- the failure rate observed on cards: TrueLayer claims a success rate of 96.5% of payment transactions made with PayDirect, compared to 85% for card payments. According to FinTech, open-banking credit transfer avoids the main sources of error that lead to low card resolution rates:

- manual input errors on card numbers

- false positives in anti-fraud parameters

- spending limits

- card expiration dates

- the threat that strong authentication represents on the the customer experience: TrueLayer relies this time on the results of SCA implementation tests carried out by Microsoft on its shopping websites; if the authorization approval rates are improving, these tests point out the impact of this new measure on online shoppers (failures or abandonments).

- the failure rate observed on cards: TrueLayer claims a success rate of 96.5% of payment transactions made with PayDirect, compared to 85% for card payments. According to FinTech, open-banking credit transfer avoids the main sources of error that lead to low card resolution rates:

- An initial resistance to overcome: TrueLayer admits that the main obstacle to the democratization of this solution is the resistance of merchants to implement a new type of payment solution. Its objective is therefore to convince merchants by increasing their conversion rates on the one hand and customer satisfaction on the other hand, notably thanks to the instant refund functionality. Once PayDirect was implemented, TrueLayer found that 1 in 4 customers chose this payment option for the quality of the experience.

MARKET PERSPECTIVE

- TrueLayer recently raised $25 million through a Series C financing round.

- In 2020, TrueLayer has experienced accelerated growth and has established itself in 12 new European countries, including France, Ireland, Spain, Italy and Germany.

- Its challenge for 2021 will be to convince European merchants about the use of Open banking credit transfers. The United Kingdom is indeed a much more mature country in this area, with nearly 2 million Open banking end users. The potential is huge for FinTech, which is targeting European marketplaces and e-merchants in particular, who could be prescribers in the choice of consumers to use credit transfers.