The FinTech Alma Aims for Small Merchants

FACTS

- The French FinTech Alma was founded earlier this year by Stripe’s former DG Italy, Louis Chatriot. They just raised €3.3 million to boost their development.

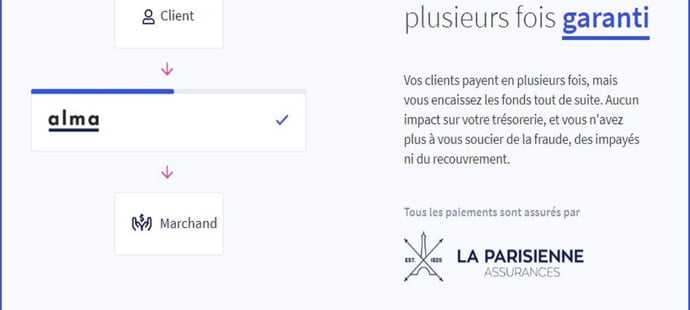

- Alma relies on a platform splitting payments in three instalments and is meant for small Web-merchants. They act as an intermediary making sure these merchants receive these payments from their customers.

- Business Model: Alma charges a 1.9% commission on fee-free transactions and 3.8% for transactions including a fee (in return, they bear all risks of unpaid debt).

- Buyers do not have to comply with prerequisites to use this credit option. Yet, in order to avoid potential risks, this start-up can assess their creditworthiness based on their e-mail address, phone number or even on banking information.

- This start-up’s activity relies on debt purchases; they depend on La Parisienne Assurances.

CHALLENGES

- Challenging long-standing credit industry players. Alma was founded to help small e-merchants become more credible as regards to their customers, enabling them to feature different means of payment, including an instalment option. According to Louis Chatriot, smaller merchants account for 40% of all sales on the French market, hence their decision to target these players.

- Testing the payment market. Besides, this start-up tries to gain momentum in the already crowded payment industry, even if they remain cautious to comply with financial regulators’ requirements. As they launch an instalment option, they make sure safeguards are in place to benefit from looser regulations.

MARKET PERSPECTIVE

- Instalments keep gaining ground in France, and Alma was founded in this context. Roughly 90 merchants from various sectors (fashion, travel industry, etc.) are using their solution. Also, from 10 to 20% of the transactions carried out on their customers’ websites are instalments-based. Other players have been aiming for the SME lending market, e.g.: Kabbage (in partnership with Alibaba).

- Alma is currently running tests on how to adjust their platform for brick-and-mortar merchants, as well. They would intend to feature this service in the months to come.

- Alma wants to attract 200 customers by the end of the year, and nearly 1,000 in 2020.