Revolut: 1.5 million European Users Already

The year 2017 witnessed multiple launches on the French market of neo-banks: Ferratum Bank, Revolut, Orange Bank, as well as non-banking offers including C zam and Morning. In this context, foreign start-ups are also growing strong: a few months ago, N26 reached the 200,000 customers milestone in France. And the British neo-bank Revolut announces they now have 220,000 users: looking back on their success story.

Revolut was launched in 2015; they broke even recently. Over the past 12 months, they beat a record and their monthly transaction volume surged to 1.5 billion dollars: +700%. To date, they would have processed 10 billion dollars in transactions.

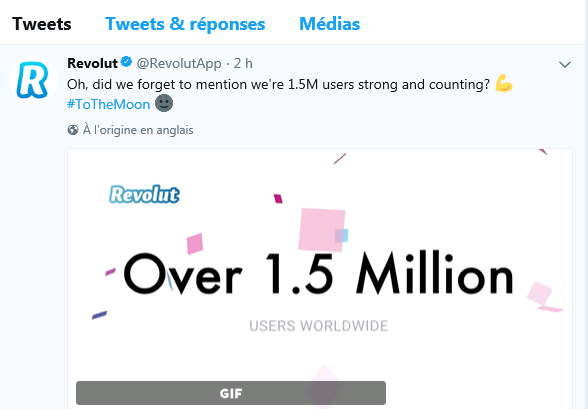

In addition, the British FinTech announced that their customer base increased by 50%: they now have 1.5 million users (compared to 1 million in the end of 2017). They claim they keep gaining even more customers: between 6,000 and 8,000 people every day. And 350,000 of these customers (roughly 1 in 4) use a Revolut card every day, while 800,000 use it every month.

Revolut entered the French market six months ago. They now report 750,000 monthly transactions (vs 110,000 in 2017). They managed to attract 220,000 customers. In their assessments, 50,000 users are active on a daily basis, and 125,000, every month. France appears as their second-biggest market, just after the UK.

Comments – Neo-banks busy attracting more customers

On a market where smartphones’ penetration rates are especially high, mobile banking players keep gaining ground. Compte-Nickel reported 800,000 account openings, and Orange Bank, 100,000; while N26 and Revolut recorded more than 200,000 users. However their success must be put into perspective, considering their youth, these new entrants do not seem to have trouble meeting their audience in France.

Unlike N26 –which has no office in France– Revolut joined Station F. They can then connect with their French users more easily, as well as with other start-ups in the same environment. The British FinTech aims for success and bets on a transparent approach in terms of prices. They should be granted a European banking licence by the end of Q1 this year. They also intend to expand their range of products and keep reaching out for more markets. Besides their new offices scheduled to open in Brazil, India, South Africa and in the United Arab Emirates, Revolut plans to establish itself in the US, Singapore and Australia. In France, a new credit offer is expected to launch in the coming months.