Pixpay publishes its pocket money barometer

FACTS

- The neo-bank for families and teenagers, PixPay, has just published its new annual barometer realized with Poll&Roll on the theme of "Money and teenagers".

- It was conducted with two main objectives :

- to better understand the relationship of teenagers and their parents with pocket money,

- Understanding the impact of the health crisis on the purchasing behavior of 10-18 year olds.

- Methodology: online survey conducted between December 4 and 9, 2020 among 1,000 parents of teenagers attending middle school and high school.

Pocket money habits

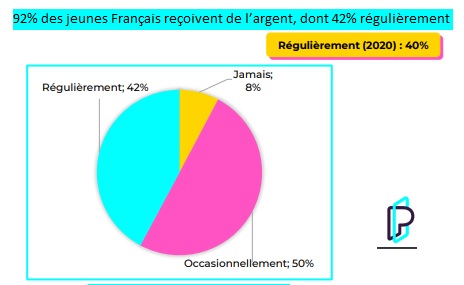

- 92% of young French people receive pocket money. Regular payments (mostly monthly) are the norm in 42% of homes with children aged 11 or older. 50% of adolescents receive their pocket money occasionally (in case of need or for occasions, parties and birthdays).

- The pivotal age of 11 years and 2 months corresponds to entry to college and the beginning of independence. For 80% of parents, this stage is primarily an educational ambition to teach their children the value of money and budget management. This age is tending to fall, since it was 11 years and 9 months in the previous barometer.

- Parents give their teenagers an average of €30 per month.

- As far as means of payment are concerned, cash is still the norm for the youngest, while the card comes to equip teenagers from the age of 16 on average.

The impact of Covid-19

- In concrete terms, the crisis has had an impact on the average amount granted, down 3 euros compared to the previous barometer conducted by PixPay in January 2020.

- It has also led them to change their purchasing behavior, just like their parents. For example, since the end of the first lockdown, 32% of teenagers visit fewer physical stores, restaurants and fast food outlets (outside of closed periods). At the same time, 27% say they have increased their online purchases.

- As for parents, 46% say they use cash less and 64% say they have increased their use of contactless payment since the beginning of the crisis.

CHALLENGES

- The virtuous circle of autonomy: One of the main lessons of this study stems from a strong trend and the digitization of exchanges. Adolescents are increasingly empowered at a younger and younger age with respect to money. They are increasingly proactive in multiplying their sources of income. They are thus mostly accustomed (58%) to selling things they no longer use to earn extra pocket money. The objective of empowerment pursued by parents seems to be reached by this use of pocket money; a practice that PixPay contributes to simplify by offering a digital solution to parents. Because the study also shows that parents (56%) are often short of cash when it comes time to give the monthly amount.

MARKET PERSPECTIVES

- PixPay reports a customer portfolio of 40,000 paying users for its services.

- Nevertheless, for Pixpay, as for the other players in financial services dedicated to young people, an educational work is still necessary. The proportion of young people who do not yet have a dematerialized means of payment remains in the majority, especially for those under 16 years old.

- Yet the market is vast. On January 1, 2020, France had 6.2% of its population aged between 15 and 19 and 17.8% of its population under 15.