E-payment: Paidy Raises $55 Million

The Japanese start-up announced a successful funding round in 2016, and just raised another 55 million dollars. This round table was led by Osaka-based Itochu Corporation, and the US VC Goldman Sachs. Paidy raised 80 million dollars all in all.

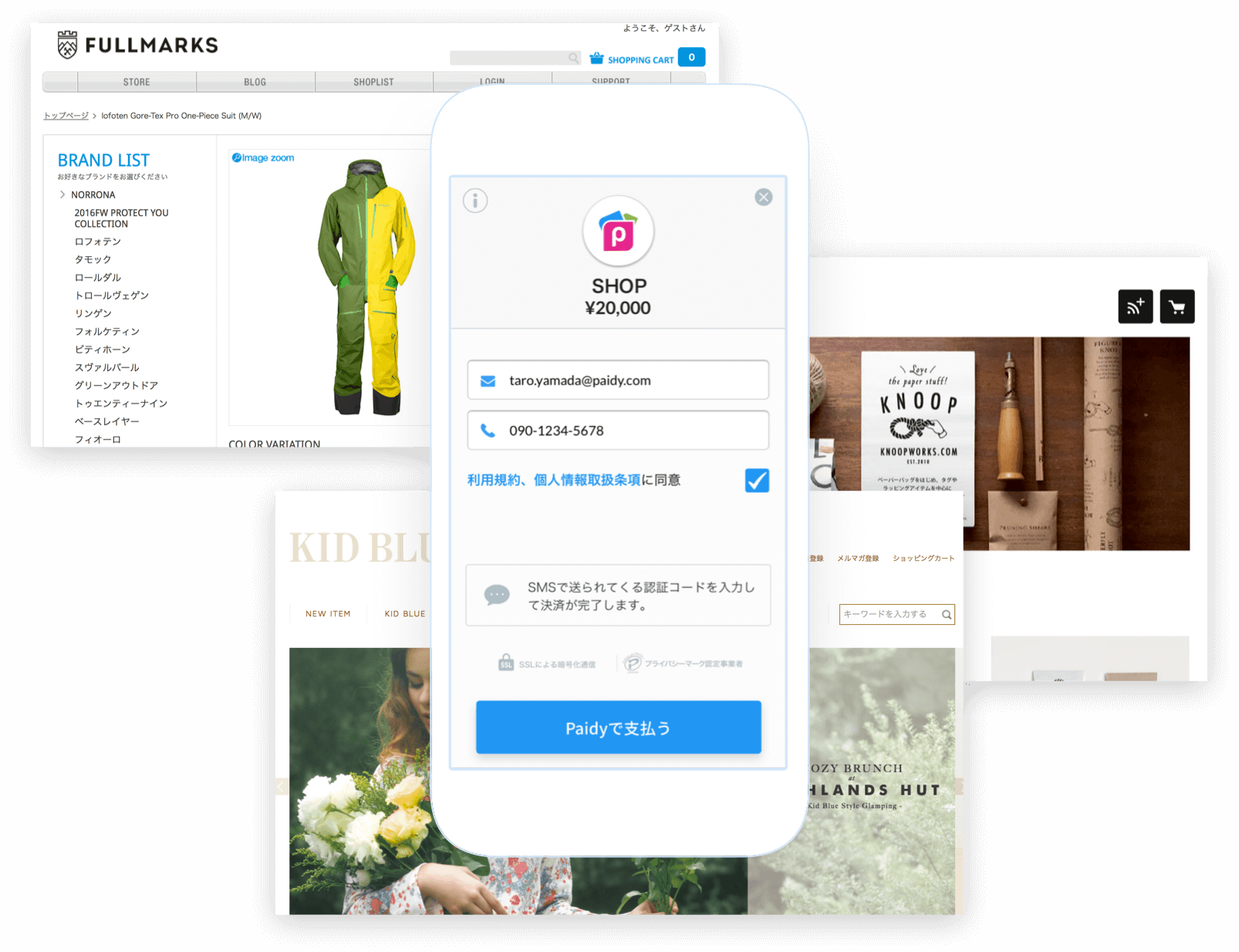

Paidy launched the first cardless payment and credit system in Japan, enabling their users to pay online without having to provide their card number. This FinTech relies on their own financing platform to verify the applicants’ creditworthiness.

Paidy users can pay for their e-purchases via specifying an e-mail address and phone number. The verification process is carried out via instant SMS confirmation, sending them a dour-digit code. The start-up relies on Machine Learning technology to reduce transaction time.

This FinTech now has roughly 1.4 million active accounts and aims to attract 11 million customers by 2020. They intend to scale up through addressing large-scale merchants and the market for offline transactions.

Comments – Cardless e-payments, a revolution in progress

Payment card penetration rates in Japan are high, but use rates remain rather low. Many purchases are conducted online, and many are mobile-based. Yet, 45% of these payments rely on other means than payment cards, including credit transfers and cash-on-delivery. Paidy meets the needs of Japanese Internet users in terms of simplicity and security.

Securing payments and providing guarantees to merchants are central to Paidy’s value proposition, as they help them increase their revenue. Also, this start-up bets on Artificial Intelligence to process transactions in a matter of seconds. Discussions would be underway with several large-scale potential partner merchants, which would provide them with extra chances to reach out from more customers.

Paidy isn’t the first company to focus on cardless e-payments. Just last month, NatWest introduced online payment solution based on bank transfer, in contradiction with payment card’s popularity among e-purchasers.