Curve moves to the U.S. and launches Curve Credit

FACTS

- Curve, the London-based FinTech that combines multiple cards and accounts into one smart card and an app, has just completed a major funding round. It now intends to expand internationally, with the US market as its main target.

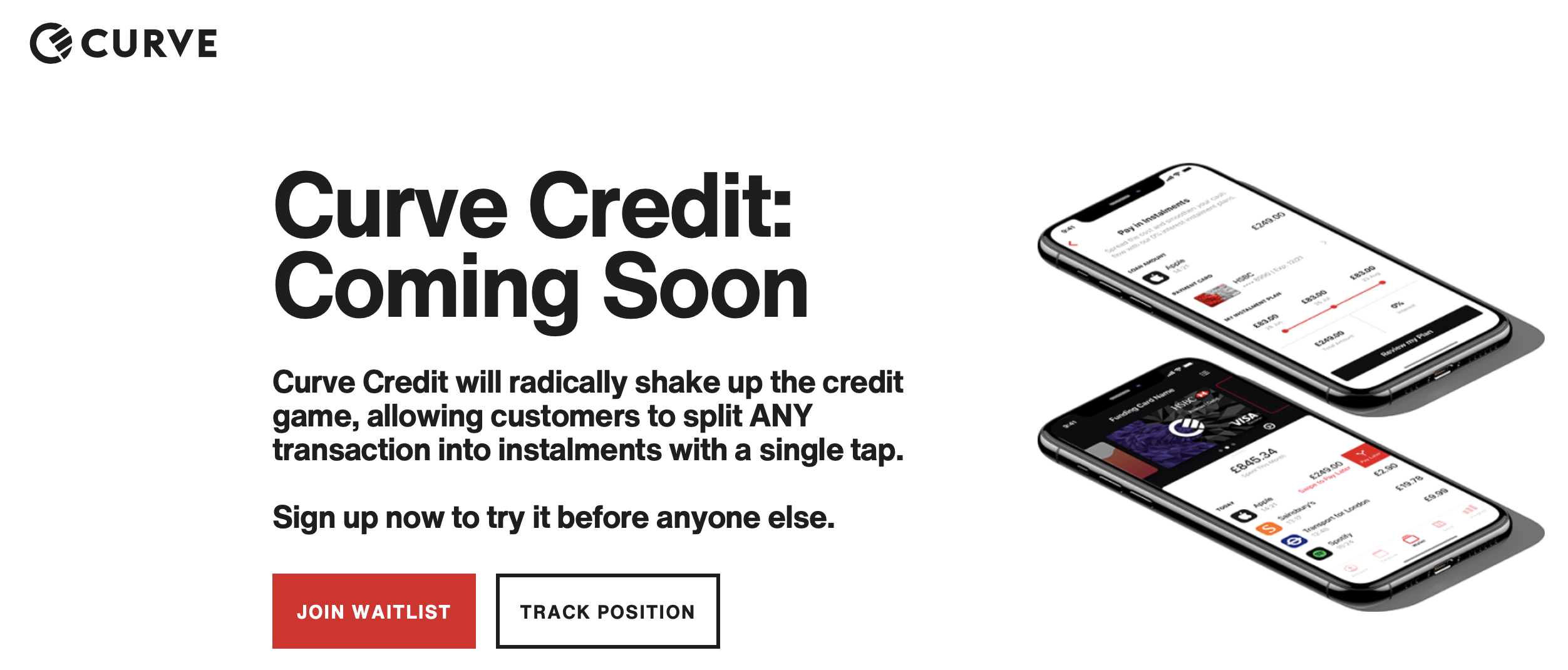

- Another new feature announced is the upcoming launch of Curve Credit, a feature that has been awaited for several months now.

- Curve aggregates all of its customers' debit and credit cards.It makes them manageable on a single platform, attached to a single card. This card allows FinTech customers to make their purchases by deciding which card to debit, even after the transaction has already taken place ("Go back in time" functionality).

- Curve is raising $95 million in a new Series C financing round led by its historical investor IDC Ventures, as well as new participants Fuel Venture Capital and Vulcan Capital.

- To date, more than 8,000 Americans have registered on a waiting list for Curve's U.S. launch, expected to be effective in the second quarter of 2021.

- Curve's other announcement is the launch of Curve Credit, a feature announced several months ago that will allow customers to make installments payments. A beta version of Curve Credit has been available in the United Kingdom since last June.

- This launch also responds to the need to clarify the use of Curve's products. Curve has found that its Go back in time feature is being used extensively to transfer debit card spending on a credit card. This trend has increased since the pandemic. Curve Credit will therefore come to fulfill this role in a more controlled way.

CHALLENGES

- A change of scale, building on its success in the UK: Curve will use these new funds to consolidate its offer and expand in the United States. The U.S. market is close to the UK market through the frequent use of credit cards and, more generally, the number of cards in the portfolio, a factor that could push the adoption of its solution in the United States. Americans have an average of 7 to 8 payment cards. Moreover, the American market remains highly fragmented, between the offerings of the incumbent banks and those of thousands of smaller banks, such as local credit unions. The challenge is also to keep pace with the many other FinTech companies that want to pre-empt the market with a financial aggregation solution, based on the model of a marketplace.

- Making the model profitable with credit: If the solution is free to the customer, Curve will charge a commission to the merchant who will see his average basket increase. This solution will be offered in several European countries, adapting to the legislation in force in each market.

MARKET PERSPECTIVE

- Many European FinTech companies are trying to make their mark in the United States (Monzo, Revolut, N26), but few are succeeding, because the challenge is huge.So far, only N26 has succeeded, with nearly 500,000 American users captured in one year. Others have experienced difficulties, including solid players such as Klarna, which has seen its losses soar as a result of its entry into the market, facing numerous payment defaults in a very tense economic climate.

- 2020 has been a challenging year for Curve, despite the success of its solution in the context of payments dematerialization. In particular, the bankruptcy of Wirecard at the beginning of the year required FinTech to completely review the processing of its cards, migrated to Checkout. This operation forced the start-up to shut down for a few days. Uncertainty reigns over its results for the year 2020, but the publication of its 2019 results show losses that have been multiplied by 4 (28 million pounds), when its revenues have doubled (5.9 million pounds).