Borrowers’ Insurance: Allianz New Online Simulator Helps Customers Save Money

Allianz France –subsidiary of the German insurance company– aims for the market of borrowers’ insurance. They unveiled an online simulator helping customers choose the most cost-effective insurance policy. This launch has been made possible as the Bourquin Amendment entered into force in the beginning of 2018.

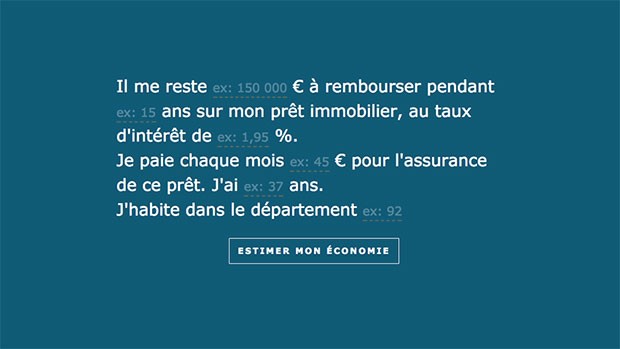

By way of helping borrowers assess how much they would save on their mortgage insurance, Allianz proposes a “savings” simulator. This tool calculates the average amount they might set aside if choosing one of the offers proposed by the insurer.

This simulator is available from allianz.fr, and the comparison process only takes a few clicks. The amount likely to be saved is calculated in less than two minutes based on information provided by the borrower: age, place of residence, remaining amount to be repaid, rate and term of the loan, etc.

Once this simulation done, the borrower is sent a quote and/or can go on with subscribing the suggested product if he wants to. Allianz Assurance Emprunteur also includes a dynamic questionnaire, so the subscription can be completed online.

Comments – The digital trend moving the lines of borrowers’ insurance, too

According to a survey conducted by Allianz, 95% of their customers know they can choose their borrowers’ insurance, and nearly 70% are aware they can now change it. However, 40% are not familiar with the required conditions for actually changing service. This insurance company decided to rely on an image-based pedagogical approach and even shared a video explanation via social networks.

This savings simulator comes in addition to the full-digital credit insurance offer they launched in March 2017.

Allianz France claims that borrowers could save 5,500 euros on average, and in 15% of the cases, even up to 10,000 euros compared to banking institutions’ offers. This insurer already manages a portfolio of more than 600,000 contracts. They want to grow their market share two-fold in the coming years.